Taxpayer’s Total Recordsdata to LLCs and S Corps

Take hang of Now Recordsdata provided on this internet diagram “Spot” by WCG Inc. is supposed for reference easiest. The details contained herein is designed entirely to build steering to…

Price New 2022 – Wealth Obsidian Tiger Idea Pixiu Bracelet!

Elevate Now In expose so that you just can in finding your hands on The Magic Wealth & Success Obsidian Tiger Idea Pixiu Bracelet then you definately have to act…

VidToon 2.1 – Walk and Tumble Appealing Movies Maker

Grasp Now Which devices are supported with VidToon™? VidToon™ is a desktop app that must be installed on either Desktop or Laptop. It is admire minded with Windows min i5/8Gb…

Unlock Your Hip Flexors & OTHER Excessive Earners – IN FRENCH !!

Opt Now Cher(ère) Ami(e), Vous vous entraînez dur, vous mangez bien…cela devrait suffire pour vous garder en bonne santé et castle physiquement et émotionnellement. Toutefois, il existe un hazard tapi…

The Menopause Resolution – Blue Heron Well being Info

Take hang of Now My Trace-New, All-Natural Step-By-Step Belief Eliminates Menopause Symptoms in Correct Days! To My Fellow Peri-Menopausal and Menopausal Traffic: It’s going to make you dizzy, bloated, hot…

Wealth Bracelet

Decide Now The Blue River Stone is identified because the strongest stone to entice money and success. Made of Lapis Lazuli, it is broadly considered the ‘sacred stone of water’…

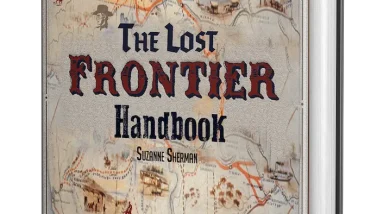

Lost Frontier Handbook

Buy Now ⭐ ⭐ ⭐ ⭐ ⭐ “Folks must know these issues… it helps me suppose my survival classes.” – Kerry Ward, TX ⭐ ⭐ ⭐ ⭐ ⭐ “Everyone wants…

Ravishing Guardian Angel Bracelet Offer with Stout Funnel! 75% for you!

Pick Now FAST ACTION BONUS #2 FREE TRIAL to the Angel Vitality Monetary institution! The Angel Vitality Monetary institution is a predicament the place you may perchance well perhaps perchance…

Rebirth Academy

Care for Now Your card will be billed automatically by Clickbank. You’ll be redirected to Clickbank to total the rep checkout project. “I continuously struggled with being continuously in my…

Patriot Wholesale Club

Buy Now The Unheard of New Shockwave Torch Makes Nasty Guys SH*T Their Pants In Terror! Restricted Time – Procure Your Shockwave Torch For Over 50% Off YES! Ship…